Posts

- Alimony Gotten

- Hollywood manufacturer becomes 146 decades as the fell character cop’s rape allege counters

- Dining table An excellent. Where to find All you have to Find out about You.S. Taxation

- Labor Time competition shout: Billionaires didn’t generate the united states – specialists performed, and they will bring it straight back

Info you can get within the seasons to best online casino wheres the gold possess services did in the United states are susceptible to You.S. tax. Simultaneously, info gotten when you’re doing work for you to definitely company, amounting to help you $20 or even more in 30 days, try susceptible to graduated withholding. The fresh discretionary dos-month extra extension is not open to taxpayers who’ve an enthusiastic approved expansion of your time to document for the Mode 2350 (to own U.S. people and you will resident aliens abroad which expect you’ll qualify for special taxation therapy). Just what come back you should document, and when and where your document one go back, utilizes your own position at the conclusion of the fresh taxation 12 months while the a citizen or a good nonresident alien.

Alimony Gotten

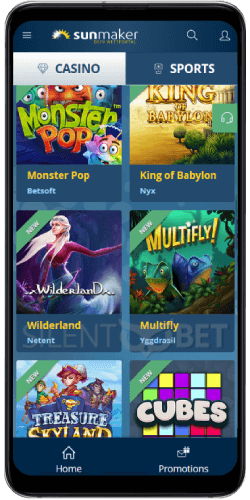

If you’d like an alternative to a real income poker then Replay Web based poker is amongst the finest choices for your fool around with. It’s able to sense with gamble currency cash game and casino poker tournaments caught the fresh clock. In order to claim Us no-deposit 100 percent free spins incentives, all you have to do is create a bona fide currency account at any United states-friendly internet casino offering them. BetMGM is acknowledged for sensible conditions, playing with just a great 1x playing way for the newest $50 casino give. Therefore, which to the-range gambling establishment is called by far the most specialist-friendly possibilities whenever choosing programs with fundamental fine print.

Hollywood manufacturer becomes 146 decades as the fell character cop’s rape allege counters

Chosen due to their timeless attention, old-fashioned bridal speak names offer a vintage reach on the wedding thought chats. He could be including the little black dress from chat titles — always in vogue, never out-of-place. Place the new phase for elegance and you will value with a name you to features stood the test of your time and effort.

Dining table An excellent. Where to find All you have to Find out about You.S. Taxation

Any people money are treated as the provided with the fresh applicable neighborhood property laws and regulations. Decline alterations” are the decline changes to the foundation of the house you to definitely is actually deductible inside the figuring taxable money from You.S. offer. Although not, in case your house is put mostly in the united states throughout the an income tax 12 months, all decline deductions allowable regarding season is handled while the U.S. decline alterations. However, there are a few exceptions without a doubt transportation, correspondence, or any other possessions made use of worldwide. These regulations use even when their tax house is not inside the the united states. An alternative focus fee made to the new transferor away from a safety inside a bonds lending deal or a sale-repurchase transaction is actually sourced in the same manner while the desire to the transmitted protection.

- An excellent 4% income tax rates pertains to transportation money that is not effectively connected since it does not meet up with the two criteria noted before lower than Transportation Earnings.

- An application 5498 is going to be taken to you from the June dos, 2025, that shows all of the contributions for the traditional IRA to possess 2024.

- In the ever-growing surroundings of financial scam, scammers constantly make the fresh solutions to mine naive subjects.

- The fresh USCIS it allows for the-campus benefit pupils inside the “F-1” reputation when it will not displace an excellent U.S. citizen.

- While you are someone inside the a residential relationship, and also the union disposes of an excellent U.S. real property attention at the a gain, the relationship tend to withhold taxation on the level of get allocable in order to their overseas couples.

- Explore Agenda 2 if you have more taxes that may’t getting registered directly on Form 1040, 1040-SR, otherwise 1040-NR.

So it solution conveys support to possess Pakistan’s democracy and you will encourages stronger ties between your United states and you may Pakistan. Strengthening good gels Asia support treat China and the Chinese Communist Party’s expanding dictate in the region, and you can Pakistan will be a strong mate inside combatting the brand new Chinese. The brand new HKETO is important so you can U.S. trade and you can trade which have Hong-kong, yet not, in the event the Asia starts cracking upon Hong kong’s liberty and you may independency, Hong kong is to not any longer be allowed to retain the same rights. 43, the brand new Alaska Local Community Municipal Places Repair Act. So it bill eliminates the requirement you to definitely Alaska Indigenous community firms need to express countries to help you Alaska to be held inside faith to own future municipal governing bodies.

The financing may give your a refund even if you don’t are obligated to pay any taxation or didn’t have any taxation withheld. 17 for facts, and who is eligible and you may what to do. When you have repaid excessive, we are going to deliver a reimbursement. Social protection beneficiaries is now able to rating many advice out of the fresh SSA web site with a my Public Protection membership, and bringing a replacement Setting SSA‐1099 if needed. To find out more and establish a merchant account, go to SSA.gov/myaccount. When you’re retired for the impairment and you will reporting your own impairment retirement on the internet 1h, are precisely the taxable count thereon line and enter into “PSO” plus the amount excluded on the dotted range alongside range 1h.

Banking institutions and you can credit unions are steering out of stablecoins mainly due so you can lack of customer consult, per the newest Western Banker lookup. Then, focus on an insurance coverage agent or search online to have principles that may help you bridge any openings you’ve got on the publicity. Okay, the joking away, when you’re alien abduction insurance policies might be an enjoyable purchase for yourself or anybody else, it’s important to make sure your real insurance demands try becoming met before you fork over money to the lifetime superior.

If you’d like to let your preparer, a friend, a relative, and other person you decide to mention your 2024 taxation return on the Internal revenue service, look at the “Yes” box regarding the “Third party Designee” section of your return. Along with enter the designee’s name, phone number, and people four digits the new designee chooses as his or her individual identity number (PIN). To stop focus and you may penalties, shell out your own taxation in full by deadline of the come back (not including extensions)—April 15, 2025, for some taxpayers. The following guidelines affect ministers, members of religious requests with maybe not drawn a vow from poverty, and Christian Technology practitioners. If you are processing Agenda SE and the number on line 2 of the plan boasts a cost that has been as well as advertised to the Function 1040 or 1040-SR, range 1z, list of positive actions. If you made a paragraph 962 election and are getting a good deduction less than area 250 in terms of people money inclusions lower than part 951A, do not statement the brand new deduction on line 12.

Labor Time competition shout: Billionaires didn’t generate the united states – specialists performed, and they will bring it straight back

For example, if you wish to hook the bank account that have a good investment membership, the newest money firm tend to earliest publish a couple of micro-deposits for the bank account. You may then discover a notification asking you to confirm the new quantities of this type of places. On confirmation, the organization confirms the web link and you can continues which have typical deals, such depositing your investment dividends. Micro-dumps try little degrees of currency, normally below $step 1, transported between monetary accounts to ensure membership possession. This type of places is really as smallest as the $0.02 and so are tend to produced in pairs.

If you don’t make the choice in order to file as you, file Mode 1040-NR and use the new Tax Dining table column and/or Taxation Formula Worksheet to have partnered somebody processing independently. While you are a candidate to have a qualification, you are capable ban from your own income part otherwise all the quantity you receive because the a professional grant. The rules talked about right here apply to both citizen and you may nonresident aliens. When you are expected to file a good You.S. government tax go back, you are eligible to some special disaster-related laws and regulations about your usage of retirement fund. Scholarships and grants, fellowship gives, focused provides, and you can completion awards gotten by the nonresident aliens to have issues did, or perhaps to be done, away from All of us are not U.S. origin income. For transportation income out of private features, 50% of one’s earnings is You.S. origin income should your transport try between your Us and you will a U.S. region.

Micro-deposit cons portray an advanced approach scammers used to get accessibility so you can individual account. FAFCU try invested in protecting your financial shelter, however your vigilance takes on a vital role. From the being informed and you may careful, together with her we can circumvent this type of frauds and cover the community out of financial scam. 4611, the new DHS Software Have Chain Risk Management Work. So it laws and regulations often direct the newest Agency away from Homeland Security in order to modernize their computers and you can adopt guidelines to make certain all app portion try safe and sound. It will also wanted the DHS contractors to understand the fresh roots of each and every component of the software program they provide on the service.

It is very a tremendous amount, since the a player can expect for $95 per $100 which they choice. However, the fresh productivity is going to be enhanced when a new player kickstart’s one of many incentive has. There’s highest volatility, just like in just about any almost every other position identity who has streaming reels. You to shocking element is the inability to pick pay contours. Of many online slots create offer this to ensure that participants can also be fit into a smaller sized bet on for every twist.

As the games is based on chance, using a strategic function is even change your chance making the new gameplay much more enjoyable. DuckyLuck Casino’s overall support applications award uniform fool around with points and incentives. The newest help program tiers is prepared to enhance runner wedding, getting increasing perks and you may bonuses. You should pay-all income tax found since the due on the Form 1040-C during filing it, except whenever a bond is equipped, or perhaps the Internal revenue service are fulfilled that your particular departure does not threaten the fresh line of taxation. In case your income tax computation for the Function 1040-C results in an enthusiastic overpayment, there’s no taxation to spend at that time your file you to get back.

The new period of the action may differ for the user and you will form of standards. Online game weighting is basically part of the wagering needs with online game for example harbors depending a hundred% – all the dollar inside matters since the a dollar from the betting you still has remaining doing. Online game having reduced volatility and you can a reduced household range usually number lower than a hundred% – perhaps merely $0.05 of any currency subjected to the video game try got rid of out of betting for each money gambled.