Comprehensive Forex Trading Tutorial for Beginners

If you’re looking to dive into the world of Forex trading, you’ve come to the right place. This tutorial will cover everything from basic concepts to advanced trading strategies, helping you navigate the foreign exchange market with confidence. Don’t forget to explore reliable brokers like forex trading tutorial Uzbekistan Brokers for your trading needs!

1. Understanding Forex Trading

Forex trading, or foreign exchange trading, is the process of buying and selling currencies on the foreign exchange market. It is one of the largest and most liquid financial markets in the world, with a daily trading volume exceeding $6 trillion. As a trader, you speculate on the value of currencies relative to one another, making profits from the fluctuations in their exchange rates.

2. Basic Concepts of Forex Trading

2.1 Currency Pairs

Currencies are traded in pairs, such as EUR/USD (Euro/US Dollar) or USD/JPY (US Dollar/Japanese Yen). The first currency in the pair is called the base currency, while the second is the quote currency. The price of a currency pair reflects how much of the quote currency is needed to buy one unit of the base currency.

2.2 Bid and Ask Price

The bid price is the amount buyers are willing to pay for a currency pair, while the ask price is the amount sellers are asking for. The difference between these two prices is known as the spread, which is a cost of trading.

2.3 Leverage

Leverage allows traders to control larger positions with a relatively small amount of capital. For example, with a leverage of 100:1, you can control $10,000 worth of currency with just $100. While leverage can amplify profits, it also increases the risk of significant losses.

3. Types of Forex Analysis

3.1 Fundamental Analysis

This method involves analyzing economic indicators, interest rates, and geopolitical events that can affect currency values. Reports on employment, inflation, and GDP growth are critical when making trading decisions.

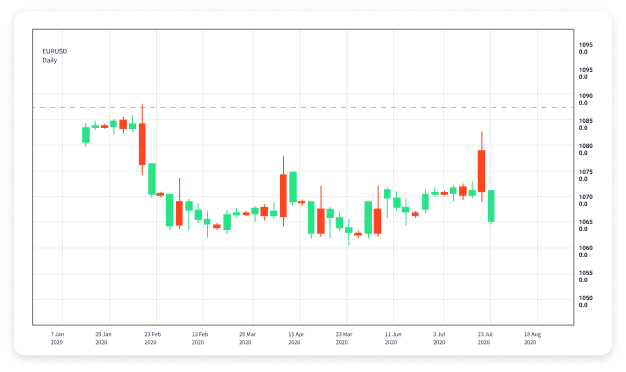

3.2 Technical Analysis

Technical analysis involves using historical price data and charting tools to predict future price movements. Traders use indicators such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) to help identify potential entry and exit points.

3.3 Sentiment Analysis

Sentiment analysis gauges the mood of the market to make trading decisions. It considers the behaviors and attitudes of other traders, helping you understand if the market is bullish (optimistic) or bearish (pessimistic).

4. Developing a Trading Strategy

A well-thought-out trading strategy is essential for success in Forex trading. Here are some steps to develop your trading strategy:

4.1 Define Your Trading Goals

Establish your financial goals, risk tolerance, and time commitment. Determine whether you want to be a day trader, swing trader, or long-term investor.

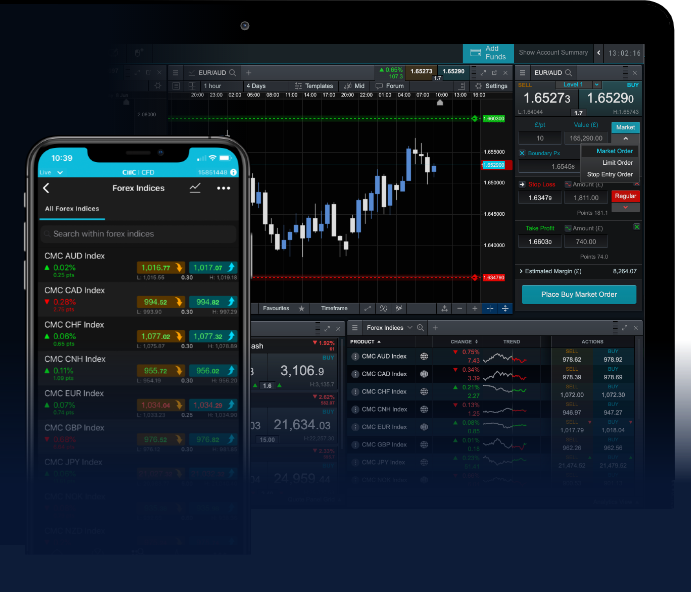

4.2 Choose the Right Tools

Select a reliable trading platform and tools that suit your trading style. Most platforms offer charts, news feeds, and analytical tools that can aid in your decision-making process.

4.3 Backtesting

Before implementing your strategy, conduct backtesting to see how it would have performed based on historical data. This can help identify strengths and weaknesses in your approach.

5. Risk Management

Risk management is a crucial component of Forex trading. Here are some strategies to protect your capital:

5.1 Use Stop-Loss Orders

Setting stop-loss orders limits your potential losses by automatically closing your position at a predetermined price level.

5.2 Position Sizing

Determine how much capital you are willing to risk on a single trade. A common rule is to risk no more than 1-2% of your trading capital on any one trade.

5.3 Diversification

Spreading your trades across different currency pairs can help reduce risk. Avoid putting all your resources into a single trade to safeguard against market volatility.

6. The Importance of Discipline and Psychology

Emotional control is vital in Forex trading. Traders often succumb to fear and greed, leading to impulsive decisions. Here are some tips to maintain discipline:

6.1 Stick to Your Plan

Follow your trading plan and avoid deviating from your predetermined strategy, even in the face of losses.

6.2 Keep a Trading Journal

Document your trades, including the rationale behind each decision. This practice can help identify patterns in your behavior and improve future trading performance.

7. Ongoing Learning and Adaptation

The Forex market is continuously evolving. Stay informed about global economic trends, new trading strategies, and technological advancements. Participate in forums, read books, and attend webinars to expand your knowledge.

Conclusion

Forex trading can be a profitable endeavor if approached with the right knowledge, strategies, and mindset. By understanding the fundamental concepts, conducting thorough analysis, and implementing effective risk management, you can enhance your trading performance. Remember that practice and continued education are key to your success in the Forex market.