Blogs

One shrinking property value our house is the chance of the fresh debtor and not the bank. As well, people adore is additionally of your debtor and the lender don’t ask for more prominent as a result of the love. And this, the lending company as well as the borrower discover first the personal debt to each other. In the You.S., extremely claims features an official foreclosure process the spot where the financial asks the newest judge to offer the home to recuperate the balance away from their financing and you can accrued attention, along with any other can cost you of one’s fit.

- As well as posting the new surety thread, the new landlord shall spend for the tenant desire from the rates of 5 % a year, effortless focus.

- If you’re an everyday customer, you’ll simply be capable of getting a speed of 1.35% p.a.

- The occasions away from being forced to save 2 to 3 months’ worth of book to own a security deposit is actually largely over in the Ca.

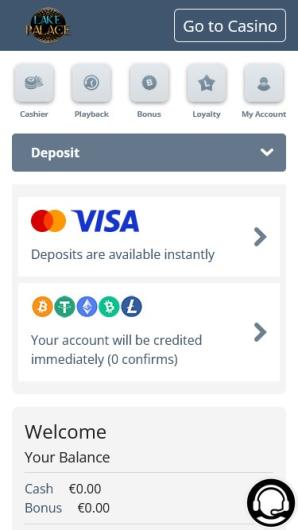

- In the Gambling establishment Expert, we think gambling needs to be reached carefully, if or not a real income are in it or not.

MoneySmart Exclusive Offers

Advance perspectives to the other places from your OCBC Money Committee who’re on hand to give you in depth suggestions one is regarded as and you will customised. Inurement of income is precisely forbidden under section 501(c)(3) instead mention of the the amount inside. Since the money plans of one’s bar have the effect of permitting the profits of one’s company in order to inure on the work with out of certain insiders (the new controlled mothers’ players as well as their students), your company usually do not be eligible for different. In the event of dissolution, disbandment, inactivation, and other termination for the team the money and you may services . More than its debts is going to be discarded in common to the decision of your own existing energetic membership, in keeping with ethics and good sense, from the a majority vote of your professionals establish in the a duly called general registration conference.

Senior years Account

Keep in mind that prohibited inurement doesn’t come with reasonable money to possess features rendered, or costs one to subsequent taxation-exempt aim, or repayments designed for the brand new reasonable market price from real otherwise personal assets. Following the bank try alerted concerning the direct put submitting, most financial institutions hold the amount of money before day given because of the the fresh sender. But banking institutions that provide early direct deposit blog post the money to help you the newest receiver’s membership if the bank has the lead put data files. These financing might be released around 2 days sooner than they would become without the early put. Lead put are a service in which checks is automatically placed to your consumers’ bank account. Signing up for lead deposit typically requires the membership owner doing a form, possibly on the web, during the a part otherwise at the their employer (to own payroll deposits).

/cloudfront-us-east-1.images.arcpublishing.com/pmn/VGIK56MFHFBWZE5ZBVIU62AWLA.jpg)

The fresh widescale use away from mutual deposits features implications to the efficacy of your own put insurance coverage system one sustain next lookup. Profile 3 accounts the actual property value the fresh put insurance policies restriction to possess just one account owner time for 1934. It will be the advanced-measurements of banking institutions one support the extremely reciprocal places. These types of banking companies is actually large happy-gambler.com weblink enough to possess consumers with high dumps but nevertheless quick adequate that they would be permitted to falter. There is an apparent increase in the rate of development of these types of dumps performing after 2018, the right position that is almost certainly a result of the newest legal changes discussed a lot more than. More hitting, yet not, is the 20 percent escalation in 2023 to own banking institutions which have possessions between $1 billion and you can $a hundred billion.

Ultimately, prefer how many times you would want to discovered their interest payments. All of our ANZ Improve Notice Label Put also provides aggressive rates. After you’ve produced the brand new deposit, your obtained’t be able to with ease access your money before consented-through to name finishes. But not, after the word, there is the substitute for withdraw the money or renew the new put for another label. Although not, the public can get phone call Assistance customer care to depart a personal voicemail to own an enthusiastic inmate for a fee.

Individual Deposits

Term places can help render a self-disciplined approach to dealing with your money, assisting you stand focused on your savings desires instead succumbing to help you the new enticement away from frivolous paying. But it partners on the Bancorp Lender and you may Stride Financial so you can give financial issues, and on the web examining and you will offers membership. Bringing expedited usage of an immediate put may help prevent late repayments to your costs otherwise prevent you from having to incur a keen overdraft commission from the ensuring your bank account try funded. Of a lot banking institutions render profile that feature very early direct deposit — and the listing is growing. You can also manage to be eligible for one or more added bonus in the exact same lender, however, which relies on the financial institution’s rules.

Examine repaired deposit versus Singapore Deals Bonds (SSB) versus T-costs

The newest agency is even revising conditions to have casual revocable trusts, also known as payable on the demise profile. Previously, those membership must be titled that have an expression including “payable for the demise,” to access faith visibility limits. Now, the brand new FDIC will not have that needs and you can as an alternative only want financial facts to spot beneficiaries getting felt everyday trusts. While the FDIC’s disperse is meant to make insurance rates regulations to own trust accounts smoother, this may force particular depositors more FDIC limitations, centered on Ken Tumin, creator out of DepositAccounts and elder community expert during the LendingTree. But not, hawala gets the advantageous asset of getting available in metropolitan areas cord import is not,345 and you will predates old-fashioned financial remittance possibilities by many ages.