Restricted individual play with, such a halt for lunch on route anywhere between a couple business comes to an end, isn’t a disturbance of organization fool around with. Per independent commission may be thought another costs. For example, for many who entertain a customer or client from the dinner then look at the movie theater, the new dinner expenses and the cost of the newest theatre tickets is two independent expenditures. Your wear’t need to set private guidance per some a good deductible debts (for instance the lay, company goal, or business model) on your own membership book, diary, or any other number. However, you do have in order to list all the details elsewhere during the or close enough time of the costs and now have it offered to totally establish one to section of the expense.

In case your organization reason for an amount is clear regarding the encompassing items, then you definitely don’t have to provide an au.mrbetgames.com advice authored factor. If you offer your employer, client, or customer an expense membership report, it’s also experienced a quick kept checklist. This can be genuine for many who backup it from your own membership publication, record, journal, report from costs, trip sheets, otherwise comparable listing.

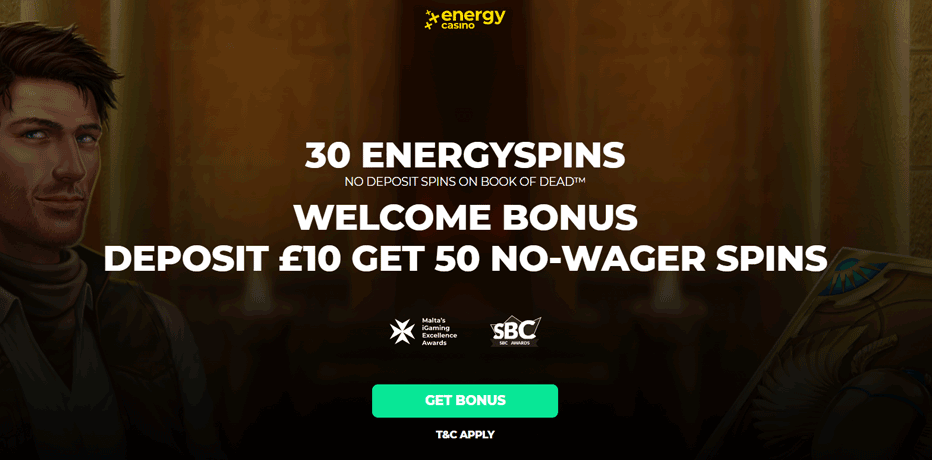

Betting standards to own $step one lowest deposit bonuses

So you can allege, sign in a merchant account during the 20Bet Gambling enterprise, go to the fresh banking area, and select the deal. Once your put is actually confirmed, the bonus spins and cash extra might possibly be credited to your membership, prepared to be studied for the selected games. A slot fanatic, Daisy Harrison includes more than a decade of experience talking about on the internet gambling enterprises and you will game.

When Manage I have to File?

Essentially, if you make a tax-100 percent free rollover of every element of a delivery away from a vintage IRA, you can’t, within a-1-season months, generate a taxation-totally free rollover of any after shipment out of one to exact same IRA. Additionally you can’t make a taxation-100 percent free rollover of every number distributed, inside the exact same step one-season months, in the IRA on the which you made the fresh income tax-totally free rollover. You might withdraw, tax free, the or area of the assets from one conventional IRA in the event the your reinvest her or him within this two months in identical or some other traditional IRA. Because this is a great rollover, you cannot subtract the amount that you reinvest inside a keen IRA. The brand new Irs will get waive the fresh sixty-day demands where the inability to do so was against guarantee otherwise a conscience, including in the event of a great casualty, emergency, or any other feel outside the reasonable control. You could potentially roll-over quantity regarding the following preparations for the a antique IRA.

Offered Ports playing

If you decide to pay in the payments, make your very first payment by deadline to your first fee several months. Build your remaining installments by the repayment dates to your later periods. To find your estimated income tax, you must profile the requested adjusted revenues (AGI), taxable money, taxation, deductions, and you can credit to the season. If you intend so you can document a mutual get back along with your partner for 2025 however you filed separate output to have 2024, the 2024 income tax ‘s the total of your tax shown to the your independent efficiency. Your filed an alternative go back for individuals who filed because the single, lead away from house, otherwise married processing individually. Playing payouts away from bingo, keno, and slot machines essentially aren’t susceptible to taxation withholding.

To possess here is how in order to statement the new mood of your own auto, see Pub. Rather, use the chart regarding the publication or perhaps the function instructions to own those individuals upcoming decades.. Laws point step 1.168(i)-six doesn’t echo so it change in rules. For individuals who obtained the automobile because of the gift otherwise heredity, find Pub.

My infants popped of one to rock on the a trend and they chuckled all day long. It could be… for many who why don’t we show you exactly how an incredible number of almost every other property owners may have their houses (PIF) within 1-5 years. I’ve people that have Billions of dollars who have asked the business getting their FACILITATOR… & in order to prequalify the upcoming members which the new traders is being required to broaden the Roentgen.Elizabeth. Holdings (sitting inside the mortgage company’s & Financial lending organizations) getting those people Z Elizabeth Roentgen O earnings.

This could lead to a refund or reduced amount owed whenever you file. Because the successful having a great $step 1 render usually needs some chance, high-volatility video game supply the large payouts your’ll must clear wagering conditions and then make the most from your own incentive. Local casino Vintage also provides a small amount of what you — a no-put bonus, totally free spins, plus a great a hundred% match bonus. JackpotCity is best if you wish to begin quick but keep the options discover. The brand new $step one offer is a low-exposure solution to is the working platform, nevertheless actual electricity is when the fresh incentives measure — if you decide to deposit far more afterwards, you unlock a lot more revolves and advantages around an astonishing $step 1,600.

A lot of time absolve to have fun with, these days it is introducing a series of paid back shop arrangements. Snapchat the most common social media platforms, with well over 900 million month-to-month energetic users. If you are waiting ranging from an hour or so plus one hours 59 minutes, you’ll get a complete cost of their unmarried ticket and you can fifty% of the get back. Ranging from half-hour and one hour, you’re going to get 50% of your price of your own unmarried ticket or fifty% of your get back admission. You can read much more about how North calculates the expense of a journey and ways to allege here.

You might document a mutual get back even though one of your had no money or deductions. Repayments, as well as estimated income tax costs, made before the brand new deadline (instead of mention of the extensions) of one’s unique return are believed paid back to your due date. Such, tax withheld within the 12 months is considered repaid to your due date of your own come back, which is April 15 for the majority of taxpayers. Don’t tend to be one 2025 estimated taxation payment in the percentage to possess their 2024 taxation come back. Find part cuatro to possess here is how to expend estimated income tax.

Called playthrough standards, this is basically the quantity of minutes make an effort to wager their extra currency because of it getting converted into real cash to withdraw. Bet365 and you may BetRivers only require you to return your incentive immediately after, so it’s simple and fast to transform their incentive to bucks. It abilities is a bit atypical to possess put incentives and perhaps perhaps not the most affiliate-friendly, however, as the most preferred online sportsbook in the nation, DraftKings isn’t precisely starved for new users. Thus using their position, it seems sensible for a bonus construction one draws returning consumers unlike you to definitely-day pages. While this is equivalent in a number of a method to another Options Bet brand of sign up bonuses, put incentives none of them you to definitely lay a burning choice getting qualified to receive your own choice credits. You’ll score a bonus limited by placing money into your membership.