Organizations can also enjoy the key benefits of processing and you may using their government taxes electronically. If or not your believe in a tax top-notch otherwise handle your own taxes, the new Irs gives you much easier and secure software to make submitting and percentage easier. Investing in securities relates to risks, and there’s always the chance of taking a loss once you spend money on ties.

Digital Submitting and you can Fee

The newest applicable rates trust if your filed needed Variations 1099. You can not recover the brand new employee express from public defense income tax, Medicare income tax, or income tax withholding from the personnel if the taxation are paid back less than area 3509. You’lso are responsible for the amount of money taxation withholding it doesn’t matter if the brand new personnel repaid taxation to your wages. You still owe a complete employer share out of public protection and you will Medicare taxes. The fresh staff remains liable for the newest staff express from social defense and Medicare taxation. Along with understand the Tips to have Setting 941-X, the newest Guidelines to own Mode 943-X, or the Tips for Setting 944-X.

- The fact there have been zero signals yet , do perspective a conundrum.

- If you’d like the new Irs to determine if or not an employee try a worker, file Setting SS-8.

- When you yourself have a tax concern not responded by this publication, view Internal revenue service.gov and how to Score Tax Let at the end of which publication.

Wage Costs

For more information concerning the payroll tax credit, see Internal revenue service.gov/ResearchPayrollTC. And understand the line 16 recommendations from the Guidelines to own Function 941 (range 17 https://happy-gambler.com/fei-cui-gong-zhu/ guidelines from the Tips for Function 943 or range 13 instructions from the Instructions for Form 944) to own information about cutting your list from tax liability because of it borrowing. To the extent its not realistic to trust they’ll getting excludable, the efforts try at the mercy of these types of taxation.

Federal Tax Withholding

The brand new Inflation Protection Work of 2022 (the fresh IRA) escalates the election amount to $five-hundred,one hundred thousand to have taxation years delivery just after December 30, 2022. The fresh payroll taxation credit election need to be produced on the or before the newest deadline of your to start with recorded income tax return (and extensions). The new part of the borrowing made use of against payroll taxes is invited in the first calendar one-fourth delivery following time that the certified business recorded its tax come back. The fresh election and you may determination of the credit matter and that is put up against the boss’s payroll taxation are built to the Form 6765, Borrowing to have Growing Search Items.

Prior to January 30, you can also fairly estimate the worth of the newest edge professionals to possess purposes of withholding and you may transferring punctually. Yet not, don’t exclude the following fringe benefits from the earnings out of extremely settled team unless of course the main benefit can be acquired to many other personnel for the a great nondiscriminatory foundation. In some cases, an SSN application can also be started online prior to seeing an SSA workplace.

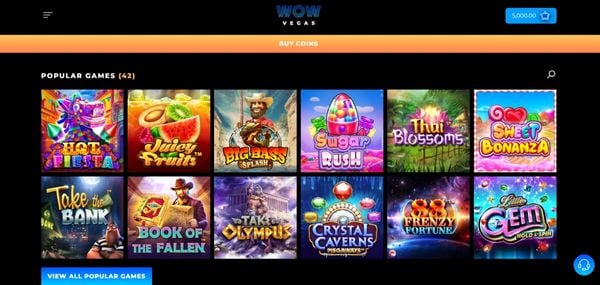

- Casinos on the internet let you know playing requirements as the multipliers one to of course essentially never ever surpass 50x.

- It could be a little unnerving observe a big family members out of cattle making the intrusion, because they as well as float on each reel.

- Government must protection out to the newest Treasury away from Guam the brand new federal income taxes withheld to the quantity paid off in order to army and civilian staff and pensioners who are residents away from Guam.

- Companies likewise have the option to alleviate information as the normal wages rather than extra earnings.

- For individuals who collect $one hundred,one hundred thousand or more in the fees for the any date through the a monthly otherwise semiweekly put months (discover Put months, prior to within this section), you need to put the newest taxation by next working day, if you’re also a month-to-month otherwise semiweekly plan depositor.

- With additional bridal party, awareness of info including gowns, arranging, and you may budgeting gets more to the point.

A vintage control interface could have been given so that people is also get their preferred bet dimensions. An additional competition is also offered which makes it easier making a fast choice having fun with an excellent slider. Today, professionals merely strike the twist switch to test out its fortune. Created by Microgaming, the online game immerses participants on the a great deal of mythical legends, highest RTP gameplay, and you can a good pantheon away from enjoyable added bonus will bring. As mentioned more than, online casinos aren’t on the market out of offering entirely 100 percent free currency. That’s precisely why they generate eastern delights $1 put bonus also provides that come with betting standards which make it tough to change a plus to your real bucks which are taken.

Shell out in the 4

15-B to have a rule away from addition of certain reimbursements in the revenues away from extremely paid anyone. An employer isn’t required to withhold federal taxation out of settlement paid to an enthusiastic H-2A staff to have farming labor performed in this regard charge but may withhold if your personnel requests withholding as well as the boss believes. If so, the brand new staff have to give the company a completed Setting W-cuatro. Government income tax withheld will be advertised in the field dos from Function W-dos.