Pocket Option Analysis: A Comprehensive Guide

The world of online trading continues to evolve, and Pocket Option has quickly emerged as a popular platform for both novice and experienced traders. Understanding how to effectively analyze this platform is key to optimizing trading outcomes. In this article, we delve deep into Pocket Option analysis, exploring strategies, tools, and techniques that traders can use to increase their chances of success in financial markets. For a detailed guide on setting up and analyzing charts on this platform, be sure to check out Pocket Option Analysis https://pocket-option.guide/nastrojka-i-analiz-grafikov/.

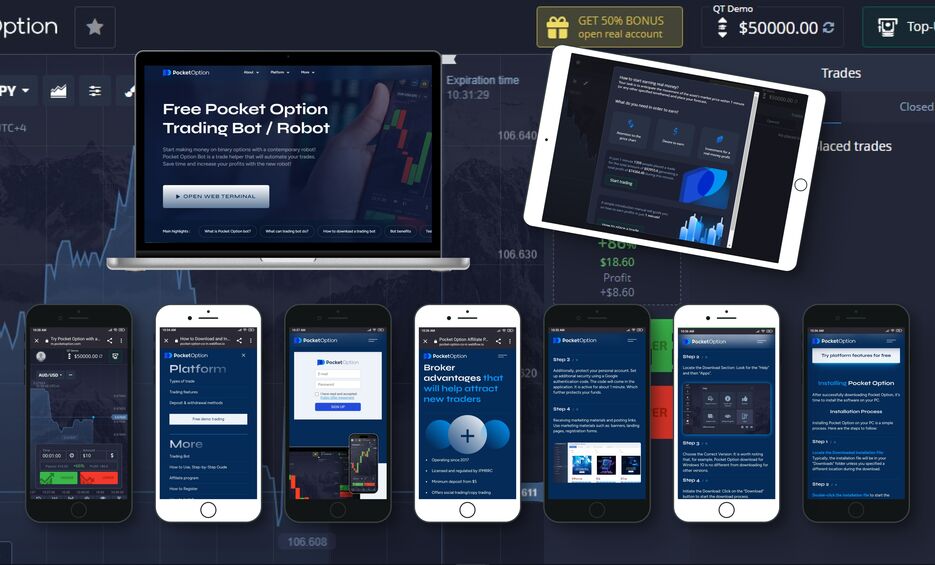

Understanding Pocket Option

Pocket Option is a binary options trading platform that offers a wide range of assets, including forex, stocks, commodities, and cryptocurrencies. It features a user-friendly interface that is accessible on both desktop and mobile devices. Traders can engage in various types of trades, including high/low options, turbo options, and more. The platform is known for its simplicity, making it an attractive choice for individuals new to trading.

The Importance of Market Analysis

Market analysis is crucial for making informed trading decisions. Whether you are day trading or holding positions longer, understanding market dynamics can significantly impact your success rate. In Pocket Option, market analysis can be broadly divided into three categories: fundamental analysis, technical analysis, and sentiment analysis.

1. Fundamental Analysis

Fundamental analysis involves studying economic indicators, news releases, and financial events that can affect the price of an asset. Traders should monitor news sources and calendars to stay updated on relevant information. For example, interest rate announcements, employment reports, and geopolitical events can cause significant price movements in the forex market.

2. Technical Analysis

Technical analysis focuses on price movements rather than the underlying value of an asset. Traders use charts, indicators, and patterns to identify entry and exit points. Tools like moving averages, RSI, MACD, and Bollinger Bands can help traders gauge market momentum and volatility. It’s important to master these tools in Pocket Option to optimize your trading strategy.

3. Sentiment Analysis

Sentiment analysis assesses the overall attitude of traders towards a particular asset. This can be gathered through social media sentiment, trading volume, and news commentary. Understanding market sentiment helps traders predict possible price direction and adjust their strategies accordingly.

Strategies for Effective Trading

With a solid foundation in market analysis, traders can employ various strategies to maximize their profits on Pocket Option. Here are a few effective trading strategies:

1. Trend Following

Trend following is a strategy that aims to capitalize on the momentum of price movements. Traders identify existing trends and enter positions in the direction of the trend. Utilizing tools like trend lines and moving averages can help confirm the strength of a trend.

2. Range Trading

In a ranging market, where prices move within a set range, traders can buy at support levels and sell at resistance levels. This strategy is beneficial when no clear trend is present and can yield consistent results based on accurate analysis of price fluctuations.

3. News Trading

News trading leverages market volatility following significant news announcements. Traders should stay updated and respond swiftly to market reactions. Effective management of risk is crucial to minimize potential losses when news impacts market dynamics.

Using Pocket Option Tools

Pocket Option provides a suite of trading tools that can enhance the trading experience. Here are some notable tools available on the platform:

1. Economic Calendar

The economic calendar provides traders with important dates for economic releases, allowing them to plan their trades accordingly. Awareness of such events helps traders avoid unexpected price movements caused by news.

2. Trading Signals

Trading signals offer suggestions based on comprehensive market analysis. These signals can guide traders in making informed decisions. However, traders should apply their analysis in conjunction with signals for maximum effectiveness.

3. Demo Account

Pocket Option offers a demo account for users to practice trading without financial risk. This is an excellent opportunity for new traders to familiarize themselves with the platform while testing various strategies and tools.

Risk Management Techniques

Regardless of how effective your analysis and strategy may be, risk management is crucial in trading. Here are some key techniques to manage risk effectively:

1. Set Stop-Loss Orders

Implementing stop-loss orders helps minimize losses by automatically closing a position when it reaches a specified level. This is a vital practice to protect your investment and manage risk exposure.

2. Diversification

Diversifying your portfolio across various assets can reduce risk significantly. Instead of putting all funds into one position, spreading investments can help mitigate losses in volatile markets.

3. Establish a Trading Plan

A well-defined trading plan outlines your goals, strategies, and risk management approaches. Sticking to a plan can help traders avoid emotional decisions and reinforce disciplined trading behavior.

Final Thoughts

Analyzing the Pocket Option platform and implementing effective strategies is essential for achieving trading success. By mastering market analysis techniques, utilizing the platform’s tools, and applying sound risk management practices, traders can elevate their trading journey. Whether you are a beginner or an experienced trader, continuous learning and adaptation are key to navigating financial markets effectively.